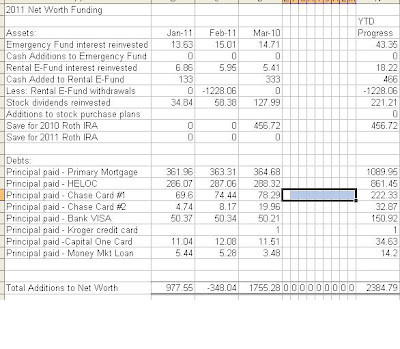

Refinancing the HELOC to an amortized 15-year loan took alot of stress out of my life by fixing the interest rate (albeit higher). This month, this loan reached that magical point where the principal portion of the payment is more than the interest portion. Something about crossing that line just makes me so much happier!!

This month statements shows: $289.56 principal and $287.34 interest.

HeyPiggy Review – Is This Survey Site Worth It?

-

HeyPiggy pays you to take surveys at home. Learn what I think of this site

in my HeyPiggy Review. Are you looking for an easy way to earn a little

extra ...