If you've read my profile over there on the sidebar, you see that I started this blog because I was fed up with the fact that these debts are keeping me from being able to build wealth for the future.

In my former life (a/k/a Before Kids), I was an avid saver. I remember the pain of cutting back my 401K contributions and my stock investments to pay for diapers and daycare. I will

never never ever regret the tradeoff because there are just too many things money cannot buy. Those little hugs I get at bedtime and sweet conversations we have during the day are all worth the stagnant net worth I've dealt with the past few years.

But, at the moment, the debts are manageable, and I'm ready to start thinking again about making some headway on that net worth number. Of course, the market conditions of the stock exchanges and real estate affect net worth. However, they are beyond my control. I am fairly comfortable with how my investments are allocated, and I just have to ride out the ebbs and flows of the markets. What I choose to save or invest from current cash flow IS in my control, and that is what I'll be tracking.

My goal for 2010 is to increase the dollar amount that I am actively adding to that net worth each month. That can be by paying down debt or by adding dollars from current income into financial assets. If I reinvest my stock dividends to purchase additional shares that is adding to the asset side. If I increase my emergency fund, that adds to the asset side. If I pay off a chunk of debt, it decreases the liabilities but increases net worth.

My goal for 2010 is to make sure that $15,000 of current annual cash flow goes directly to net worth. I am only including money that I have (or could have) direct access to. For example, mutual fund dividends inside an IRA that are reinvested will not count since I cannot access those earnings without triggering a taxable distribution. But I will include the stock dividends since I could easily opt out of the dividend reinvestment plans and receive checks each quarter.

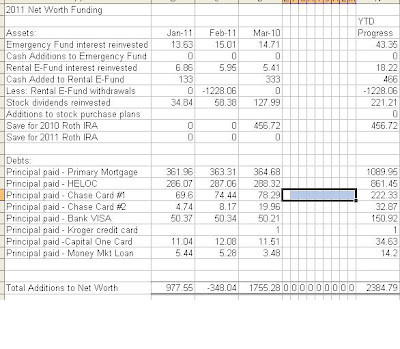

I'm hoping I'll learn how to embed an Excel spreadsheet in my post someday. In the meantime, here are the categories I'll use to track this monthly:

ASSETS:

Emergency Fund interest reinvested

Cash Additions to Emergency Fund

Rental E-fund interest reinvested

Cash Added to Rental E-fund

Less: Rental E-fund withdrawals

Stock dividends reinvested

Additions to stock purchase plans

Additions to IRAs/Roth IRAs

DEBTS:

Principal paid-Primary Mtg.

Principal paid-HELOC

Principal paid-Chase Card #1

Principal paid-Chase Card #2

Principal paid-Bank VISA

Principal paid-Kroger card

Principal paid-Capital one card

Principal paid-Money Mkt. Loan

TOTAL ADDED TO NET WORTH

Here's to hoping that this time next year that last number will be $15,000!!!